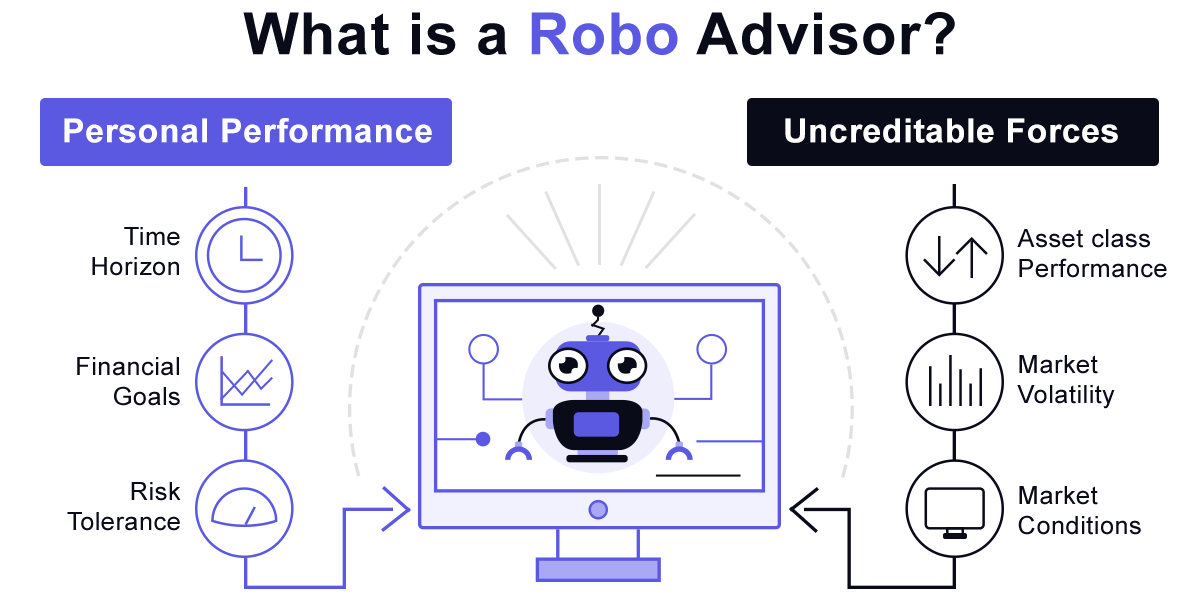

Robo advisors or automated fund managers are digital platforms that, through the use of algorithms, offer efficient portfolios of automated funds at low cost and with limited human oversight.

Robo advisors or automated fund managers are digital platforms that, through the use of algorithms, offer efficient portfolios of automated funds at low cost and with limited human oversight.

They perform a similar job to that of a financial advisor, only with a more automated method of working and usually with cheaper and more convenient investment products.

They perform a similar job to that of a financial advisor, only with a more automated method of working and usually with cheaper and more convenient investment products.

These automated managers are characterized by very low commissions (since they are portfolios made up of index funds and ETFs), an affordable initial investment (starting from 150 euros from Spain) and do not require excessive financial knowledge on the part of the investor.

These automated managers are characterized by very low commissions (since they are portfolios made up of index funds and ETFs), an affordable initial investment (starting from 150 euros from Spain) and do not require excessive financial knowledge on the part of the investor.

On the other hand, to access a financial advisor, the minimum initial investment required is much higher. The average in Spain is around 50,000 euros, plus higher fees.

On the other hand, to access a financial advisor, the minimum initial investment required is much higher. The average in Spain is around 50,000 euros, plus higher fees.

For this reason, robo-advisors have become a growing alternative for small savers, particularly those who have the ability to save, but don't have a large amount of cash on hold.

For this reason, robo-advisors have become a growing alternative for small savers, particularly those who have the ability to save, but don't have a large amount of cash on hold.

Even though they call themselves robo-advisors, that doesn't mean that there isn't an investment committee behind them that oversees these algorithms, so it can't be said that they are “100% automated”.

Even though they call themselves robo-advisors, that doesn't mean that there isn't an investment committee behind them that oversees these algorithms, so it can't be said that they are “100% automated”.

Currently, most of the robo advisors in the market use modern portfolio theory to build their index portfolios. I can create predefined portfolios for investors with different risk profiles.

Currently, most of the robo advisors in the market use modern portfolio theory to build their index portfolios. I can create predefined portfolios for investors with different risk profiles.

That's exactly what you get when you invest with an automated portfolio manager: an index portfolio tailored to your investor profile.

That's exactly what you get when you invest with an automated portfolio manager: an index portfolio tailored to your investor profile.

Once these portfolios are established, the robo-advisor manages them. This involves performing a series of automatic rebalancing operations to ensure that the optimal weightings of each asset class in the portfolio are maintained, taking into account market fluctuations. In other words, the asset allocation chosen by the managers is maintained. This is the basic operation of all auto handlers. The differences between them lie in the way they compose the portfolios, the rebalancing times and, of course, the fees charged.

Once these portfolios are established, the robo-advisor manages them. This involves performing a series of automatic rebalancing operations to ensure that the optimal weightings of each asset class in the portfolio are maintained, taking into account market fluctuations. In other words, the asset allocation chosen by the managers is maintained. This is the basic operation of all auto handlers. The differences between them lie in the way they compose the portfolios, the rebalancing times and, of course, the fees charged.

There are robo advisors with portfolios made up of index funds, ETFs, pension funds, and some even with unit-linked portfolios, such as Sego Finance.

There are robo advisors with portfolios made up of index funds, ETFs, pension funds, and some even with unit-linked portfolios, such as Sego Finance.

Complete an eligibility test, which is a questionnaire that assesses your investment goals, financial situation and financial knowledge. This step only takes 15 minutes and is very important.

Complete an eligibility test, which is a questionnaire that assesses your investment goals, financial situation and financial knowledge. This step only takes 15 minutes and is very important.

Based on the result of the test, Robo Advisor assigns you an investment portfolio suited to your risk profile. Finally, all you have to do is open the account and transfer the capital to invest.

Based on the result of the test, Robo Advisor assigns you an investment portfolio suited to your risk profile. Finally, all you have to do is open the account and transfer the capital to invest.

From then on, the robo advisor will take care of the portfolio management without you having to do anything else. Most robo-advisors recommend scheduling regular contributions to your fund portfolio, which makes sense to automatically invest some of the money you save each month.

From then on, the robo advisor will take care of the portfolio management without you having to do anything else. Most robo-advisors recommend scheduling regular contributions to your fund portfolio, which makes sense to automatically invest some of the money you save each month.

The main advantages of a robo advisor are:

Low costs and competitive fees: Thanks to automation and economies of scale, Robo Advisors are on average one-third cheaper than a traditional investment vehicle. For example, Indexa Capital says you'll save 85% on commissions and other costs. Simplicity: just complete a risk profile test and you will be assigned a portfolio that is most in line with your profile. You don't need to do anything else to start investing.

Automated process: thanks to its algorithmic nature, it allows you to customize a standardized product for each customer. In addition, this process significantly reduces operational risk.

They are regulated: Robo Advisors are regulated and supervised by the CNMV and the Bank of Spain. Minimum accessible investment: there are roboadvisors that allow you to invest starting from 1 euro and others that create a portfolio starting from 150 euros, although it is normal for the initial amount to be between 1,000 and 3,000 euros, an affordable amount compared to others investment types.

They allow even small periodic payments: the roboadvisor model is ideal for those who save money every month and want to invest it automatically.

Delegated portfolio management: have your capital managed instead of being advised. It would be the equivalent of sitting in a good restaurant and enjoying your meal instead of buying the ingredients, cooking them, interpreting the recipe, plating, serving and then washing up.

Diversified and efficient portfolios: in this case, the use of ETFs and index funds offers very high diversification, creating very efficient portfolios and optimizing the risk/return ratio for each risk profile. Portfolios adapted to the client's life: the way you invest and the risk you take change over the course of your life. The best roboadvisors know this and will ask you to retest from time to time to adjust your investment profile.

Transparency: roboadvisors improve the accessibility and availability of information through their online distribution. With them we can access our wallet at any time and on any day. Usually 100% of transactions can be done online. Furthermore, most of them are very clear and transparent when it comes to communicating their costs, fees and returns, Emotional biases and investment mistakes are avoided. Some researchers argue that human emotions are extremely present in investment decisions and this leads to overreacting in certain scenarios instead of using rationality. In some cases, emotions could explain price bubbles and market behavior.

For more information on deposits & withdrawals and how to fund your trading account please click here