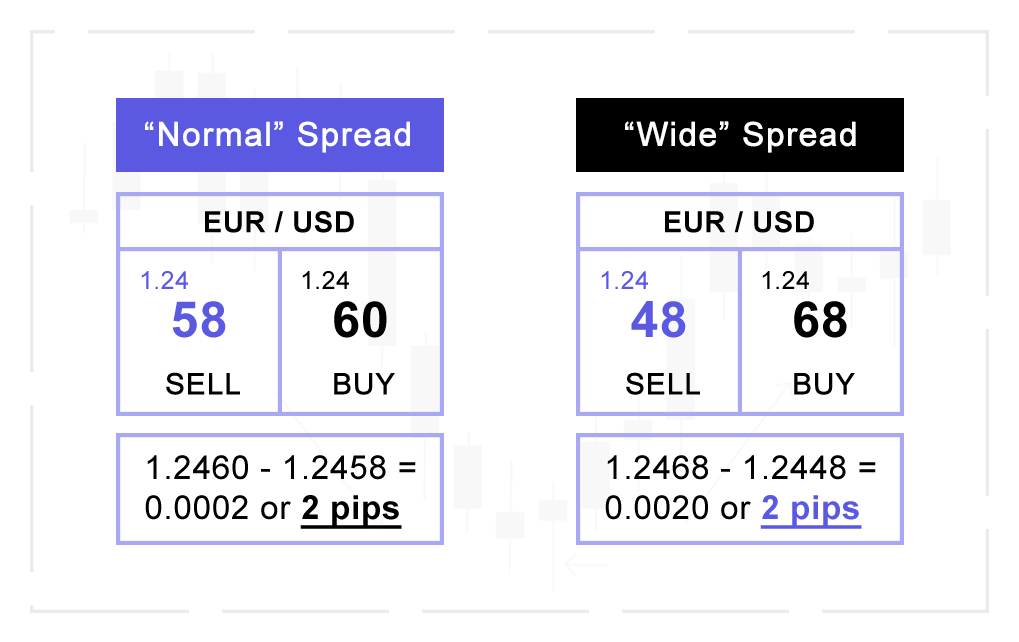

The spread is measured in pips, which is a small unit of movement in the price of a currency pair, and the last decimal point on the price quote (equal to 0.0001). This is true for the majority of currency pairs, aside from the Japanese yen where the pip is the second decimal point (0.01).

When there is a wider spread, it means there is a greater difference between the two prices, so there is usually low liquidity and high volatility. A lower spread on the other hand indicates low volatility and high liquidity. Thus, there will be a smaller spread cost incurred when trading a currency pair with a tighter spread.

When trading forex, the spread can either be variable or fixed. The spread for forex pairs is variable, so when the bid and ask prices of the currency pair change, the spread changes too.

For more information on deposits & withdrawals and how to fund your trading account please click here